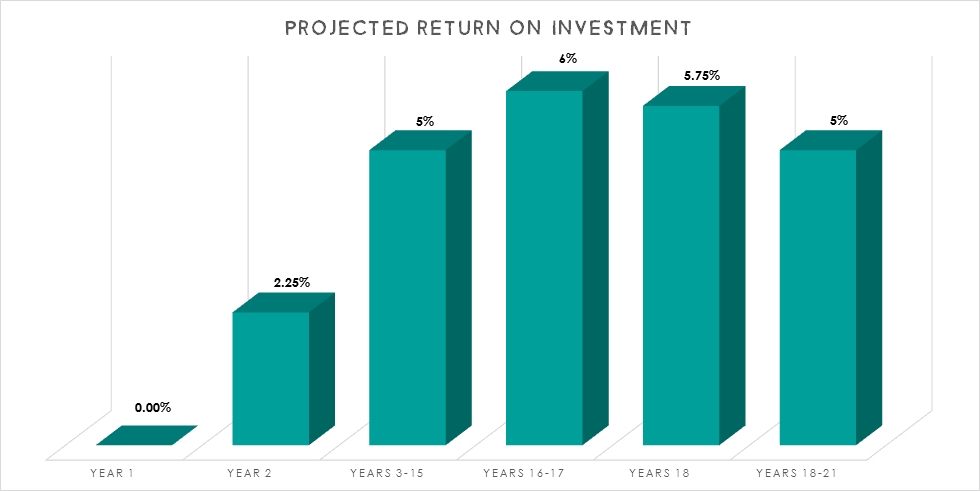

Interest Payments

Members of Community Energy Cumbria, in line with our Rules as an Industrial and Provident Society for the Benefit of the Community (IPS Bencom) are projected to receive a ‘reasonable’ return on their investment: this means paying a sufficient rate of interest to firstly obtain and then to retain enough capital for Community Energy Cumbria to operate successfully.

Community Energy Cumbria has projected an average target interest rate of 5% per annum over the 20 year operating life of the project between 2016-2036. Income generated in the first two years (2015 and 2016) will be rolled over into the third year, so first interest payments to Members are expected to be in 2017, following the Society’s AGM.

Tax Relief

Additional benefits in the form of tax relief on your initial investment may be possible through HMRC’s Seed Enterprise Investment Scheme (‘SEIS’ attracting 50% tax relief on the first £150,000 of investments in CEC) and /or Enterprise Investment Scheme (‘EIS’, soon to be replaced by ‘Social Investment Tax Relief’ (SITR), attracting 30% tax relief). For details, see page 32 of the full Share Offer Document.

Share Allocation Timetable

The Directors of Community Energy Cumbria expect to meet on or before the 11th September 2015 to confirm the allocation of shares to applicants. CEC plans to hold its first AGM in June 2016 and to make the first interest payments shortly after the second AGM in June 2017.

Community Fund

Over the 20 years of the project, payments to social and environmental projects within Cumbria are anticipated to exceed £40,000 (see Community Benefit section of this document for details). This amounts to a minimum of 20% of the total interest payments. Proposals for the distribution of this fund will be made by the Directors of the Society at the AGM at which Members will be able to vote.

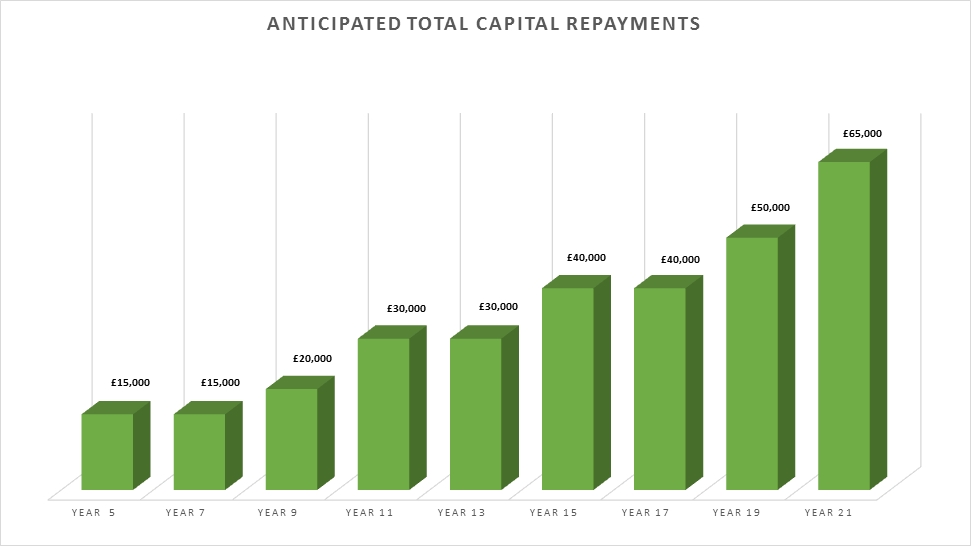

Withdrawal of Capital

Investors should be aware of the Society’s Rules in their expectation of the withdrawal of capital (See Rules 27, 28, 29, 30 and the additional discretion of the Society under this share offer to repay capital throughout the period of the projects (2016-2036)). Prospective Members should consider their investment as a long term investment and be prepared that capital might not be repaid until year 21. However, the Society plans to make limited capital repayments available from year 5, staggered across the 21 years of the project (see ‘Anticipated Total Capital Repayments’ Table below).

In common with many share issues, over the lifetime of the project some Members are likely to want to withdraw their investment for a myriad of reasons (from buying a new car, to reinvestment, to covering an emergency financial need, as examples). If a Member of the Society dies, the Society will also need to make available repayment of the capital to the Estate of the deceased.

You should be aware that the shares you own will be ‘withdrawable’, but not ‘transferable’. This means that you cannot sell or transfer them to anyone else, other than back to the Society itself. In order to reclaim their value, the Society will buy them back from you. This will normally be for the same price that you paid for them (it cannot be more), but it may be less if the value of the shares has reduced since purchase. Normally you need to give 3 months’ notice in writing if you want to withdraw any shares; in exceptional circumstances the Society may be able to buy back the shares more quickly.

At the Society’s Annual General Meetings, the Board will decide how much capital is available for repayment in the following year. Capital repayments will be allocated on a first come, first served basis upon request from Members. The Estate of Members who have died during the accounting year will take priority.

As Rules 27-30 of the Society clearly set out, the Society reserves the right to suspend share withdrawals for as long as they feel this is necessary. The Society might do this to prevent too many investors taking out their money all at once whilst the Society is building up sufficient cash reserves / contingency.

Consent to Receive Capital Repayment

By subscribing to this share issue, Members will be giving their consent to receive capital repayment at the discretion of the Society, irrespective of whether Members have or have not requested repayment of their capital / shares in any particular year.

The financial model on which annual interest payments in this Share Offer is made requires that some capital is returned to Members throughout the 21 year period of the project (i.e. the Society returns some of the original £305,000 capital investment / your shares during the lifetime of the project). Income from the generation and sales of renewable electricity is projected to pay an average 5% interest over 20 years (yr2-yr21) on any capital that is retained within the Society in any one year, but this income is insufficient to pay Members an average 5% annual interest on the full £305,000 every year for 21 years (i.e. if no capital was withdrawn for 21 years). Therefore, should there be insufficient demand from Members for the return of capital in any one year, or repayments to the Estates of deceased Members, then at the AGM the Board may resolve to require a proportion of the Society’s share capital to be withdrawn by its Members, divided proportionately amongst Members according to the number of shares each Member retains in the Society. By subscribing to this Share Offer, all Members are deemed to give any consents required to the withdrawal of the shares as described above.

Taxation

Community Energy Cumbria does not anticipate having any liability for Corporation Tax until after its capital allowances have been exhausted. CEC will be VAT registered.